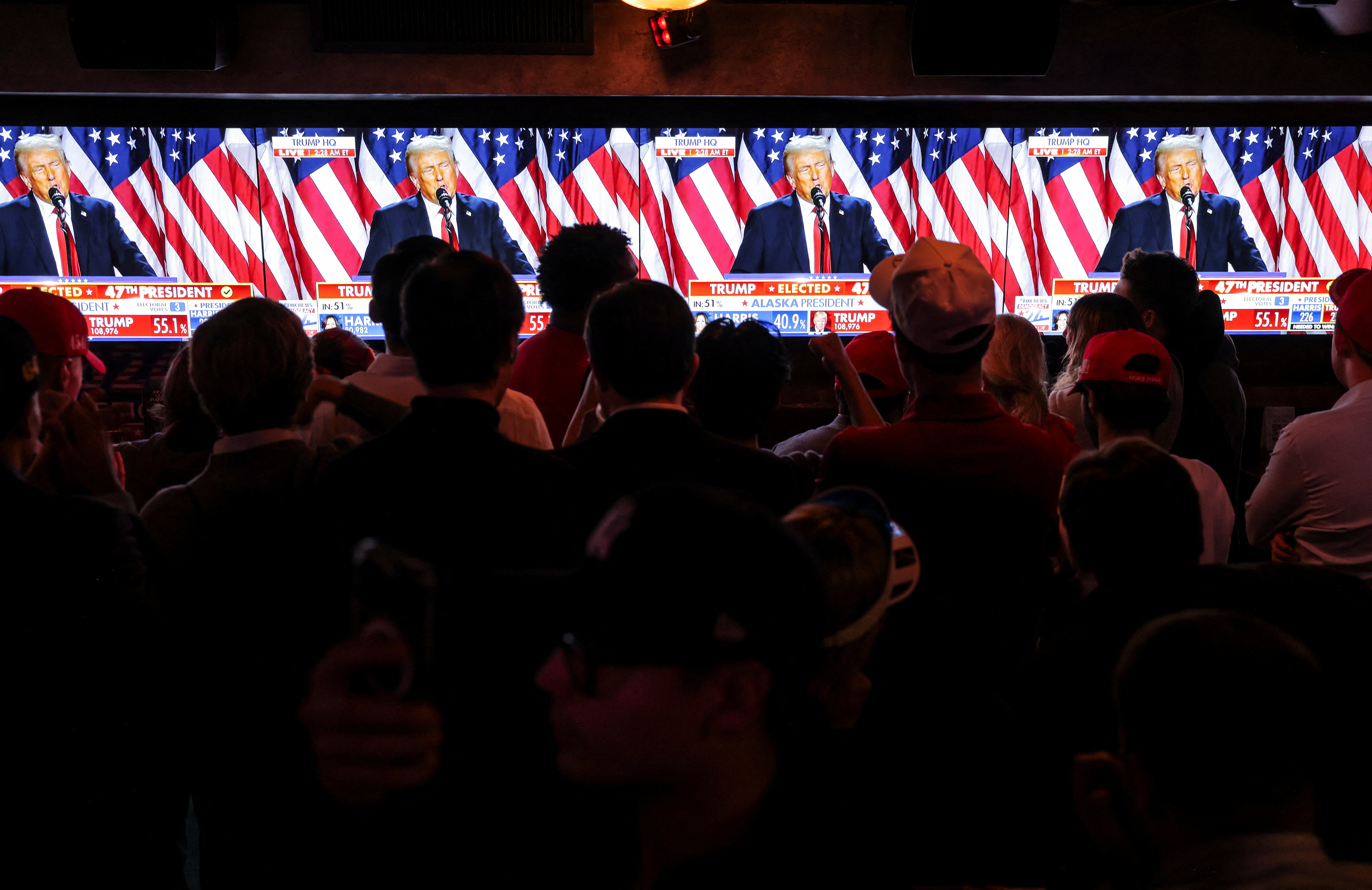

Donald Trump takes the stage following early results from the 2024 U.S. presidential election in Palm Beach County Convention Center, in West Palm Beach, Florida, U.S., November 6, 2024.

With President-elect Donald Trump returning to the White House, his economic ideas could soon become reality. Expect "America First," tax cuts, tariffs, trade wars and a cryptocurrency boom.

As the world wakes up after election day in the US, it is looking at another Donald Trump presidency.

The Republicans have also taken control of the US Senate, which will make it easier for Trump to get his economic ideas passed into law. Though the president has a number of direct executive powers, the last hurdle will be control of the House of Representatives

Trump's promise of big tariffs

A Trump win would put a new, rough spin on the global economy.

Many of his economic ideas are similar to his first time in power. This time though they are more refined and he has more experience and determination to push them through.

He has promised tariffs of 10% or 20% on all goods imported into the US and even higher tariffs of 60% on Chinese-made things.

At the same time, he has promised to bring manufacturing home, cut taxes and deport millions of irregular immigrants.

Though some of these promises may seem extreme, they were enough to convince many voters struggling with higher food and housing prices that they were better off economically supporting Trump.

How are the global markets reacting?

Trump's policies will have a big impact on the US economy, but they will also have big ripple effects across the globe.

Before the election, businesses around the world had already taken a Democratic or Republican win into account and made contingency plans.

Now that a Republican sweep seems likely the markets are reacting.

Stock markets in Asia, the first to open after the election, had a mixed reaction to a Trump win. Japan's Nikkei and Australia's S&P/ASX 200 were up. While Hong Kong's Hang Seng Index was down. Mainland Chinese stocks did not move much and European markets have been muted, so far.

Other stock exchanges are yet to open.

Bitcoin hits an all-time high

Trump has promised to make America the "crypto capital of the planet" by halting regulation and being more open to innovation. His support for cryptocurrency has given hope to the industry in the US.

Bitcoin, the most popular cryptocurrency, hit a record of over $75,000 (€69,800) at one point on Wednesday.

Many cryptocurrency advocates like Elon Musk want to see him elected. Some individuals and crypto companies have donated millions to Super PACs to support candidates of their choice.

The dominance of the US dollar

As bitcoin surged, a number of other currencies have not done so well against the American dollar

The European Union and countries like China, Japan and Mexico and are rightly worried about tariffs.

On Wednesday, many of their currencies lost value against a surging US dollar. The Mexican peso had its biggest fall in three months as it is particularly vulnerable to new US tariffs since it is the country's largest trading partner.

A more expensive dollar will make US goods more costly for others in general. It will also make global commodities that are priced in dollars like oil more expensive for buyers paying in other currencies.

European fears and opportunities

Besides trade difficulties and tariffs, a number of Eastern European countries fear that Trump may weaken or even undermine America's essential support for NATO. This fear, along with worries about the future of the war in Ukraine and who will pay, has pushed down numerous Eastern European currencies like the Hungarian forint.

To appease Trump, Europe may need to up its defense spending in general and its support for Ukraine in particular. On top of that, many of Trump's policies could lead to inflation with roots in the US and hurt other countries' ability to borrow money.

Taken together, such policies "would have particularly negative consequences for Mexico, but also for the eurozone, and closely correlated with it the Central and Eastern European region," Piotr Matys, a senior FX analyst at In Touch Capital Markets, told news agency Bloomberg.

"Donald Trump's second term in office will be a greater challenge for German and European industry than his first term," warned Thilo Brodtmann, head of the German Mechanical Engineering Industry Association, in a statement.

"We must especially take his tariff announcements seriously," Brodtmann said, adding that tariffs would strain global trade and could force China and European countries to further develop their own economic strengths.

Edited by: Ashutosh Kim