Sustainable investing solutions

“What we invest in today will determine the world we live in tomorrow.” WERNER FRIEDRICH, CEO, Target Capital Assets.

How to Invest Responsibly

It’s easier than ever to invest in a way that has the potential to make a difference and provide a financial return. Sustainability considerations are integrated into our investment process, through taking account of ESG factors and are integral to everything we do.

Our sustainable solutions build on ESG integration to provide a range of investment capabilities designed to meet clients’ financial goals and objectives whilst allowing them to invest in a way that aligns with their values and sustainability views.

-

Invest today. Change tomorrow.

Active ownership is a core part of sustainable investing.

Sustainability is a growing concern for investors – that’s why we believe that understanding the full range of environmental, social and governance risks and opportunities is key to generating strong and sustainable returns whilst having a positive impact on the environment, society and the wider world.

-

Considering sustainability risks and factors across asset classes

Our ESG House Scores

Our ESG house score is designed to shed light on a company’s management of ESG risks. We designed a proprietary ESG house score to supplement our existing analysis. The system draws on more than 100 internal and external data points from third-party providers while taking into account the factors that we feel are most relevant or important for sectors, regions and companies. to arrive at a single number, or score.

-

Active Equities

Our ESG approach to equity investing

We are active equity investors. We believe that deep fundamental research, a disciplined investment process and full analysis of environmental, social and governance (ESG) issues is the most effective way to deliver long-term returns for our clients.

Fixed Income

ESG embedded into Fixed income investing

Consideration of ESG factors is embedded in our fixed income research process. It’s one of the key dimensions, alongside other valuation metrics, on which we assess any company in which we invest. We actively engage with our investee companies, combining information from these meetings with insights from our investment managers, research analysts and central ESG investment team.

Multi Assets

ESG embedded into Multi Asset investing

At Target Capital Assets we are responsible investors. As such, we ensure environmental, social and governance (ESG) considerations are embedded in everything we do. Our goal is to make a difference – for our clients, society and the wider world. It’s about doing the right thing, while aiming to achieve our clients’ long-term financial goals. Here’s how this applies to the Multi-Asset Solutions team

Real Estate

ESG integration in Real Estate

Driven by our four stewardship and ESG principles, we put stewardship and ESG considerations at the heart of:

- Our investment process

- Our investment activity

- Our client journey

- Our corporate influence

Transportation

ESG applied in our vehicles plus well insured

We do not want any unnecessary loss, we find environmental friendly cars, depending on the location. we activate all the necessary ESG programs to maintain a better cash flow.

-

Voting

Voting is integral to our active ownership activities

We believe voting at company meetings is one of our most important activities when investing on behalf of our clients. This means we take great care to set high expectations in our voting policies. And when the companies in which we actively invest hold meetings, we assess resolutions in detail.

-

Robust Voting and Transparent Disclosure

We vote in line with our principles, always seeking to represent our clients’ best interests in the decisions we make on their behalves. Because we believe that strong business ethics and governance will generate positive outcomes, we encourage best-practice standards in our investee companies. We disclose all voting outcomes and details of engagement within 24 hours of a general meeting. Our periodic reporting to clients also details our voting activities.

-

Strong Stewardship Capabilities

We believe that better corporate behavior will provide better returns over the longer term. This means we aim to enhance and preserve the value of our clients’ investments through active and engaged ownership of their assets. We consider a broad range of factors that might affect the success of a given company. Where necessary, we encourage positive action. We share insights from our ownership experiences across geographies and asset classes.

-

-

Seeing things differently

With so many challenges facing the planet, it matters now more than ever to invest in a sustainable future. Find out how we use expert analysis and the power of investment to promote good governance and have a positive impact on society.

-

From climate change and the energy transition to global conflict and social upheaval - there are plenty of challenges facing businesses, policymakers, and investors. How can they navigate these and uncover the opportunities within? And how can these opportunities lead to real, sustainable change for the planet?

-

At TCA, we're committed to using the power of investment to create a better future for our clients, society, and the planet. By using unique research, our analysts are able to decipher complex data and identify the most urgent issues and potential opportunities. And through those insights, we're able to show how sustainable investing can be a real agent for meaningful change.

-

-

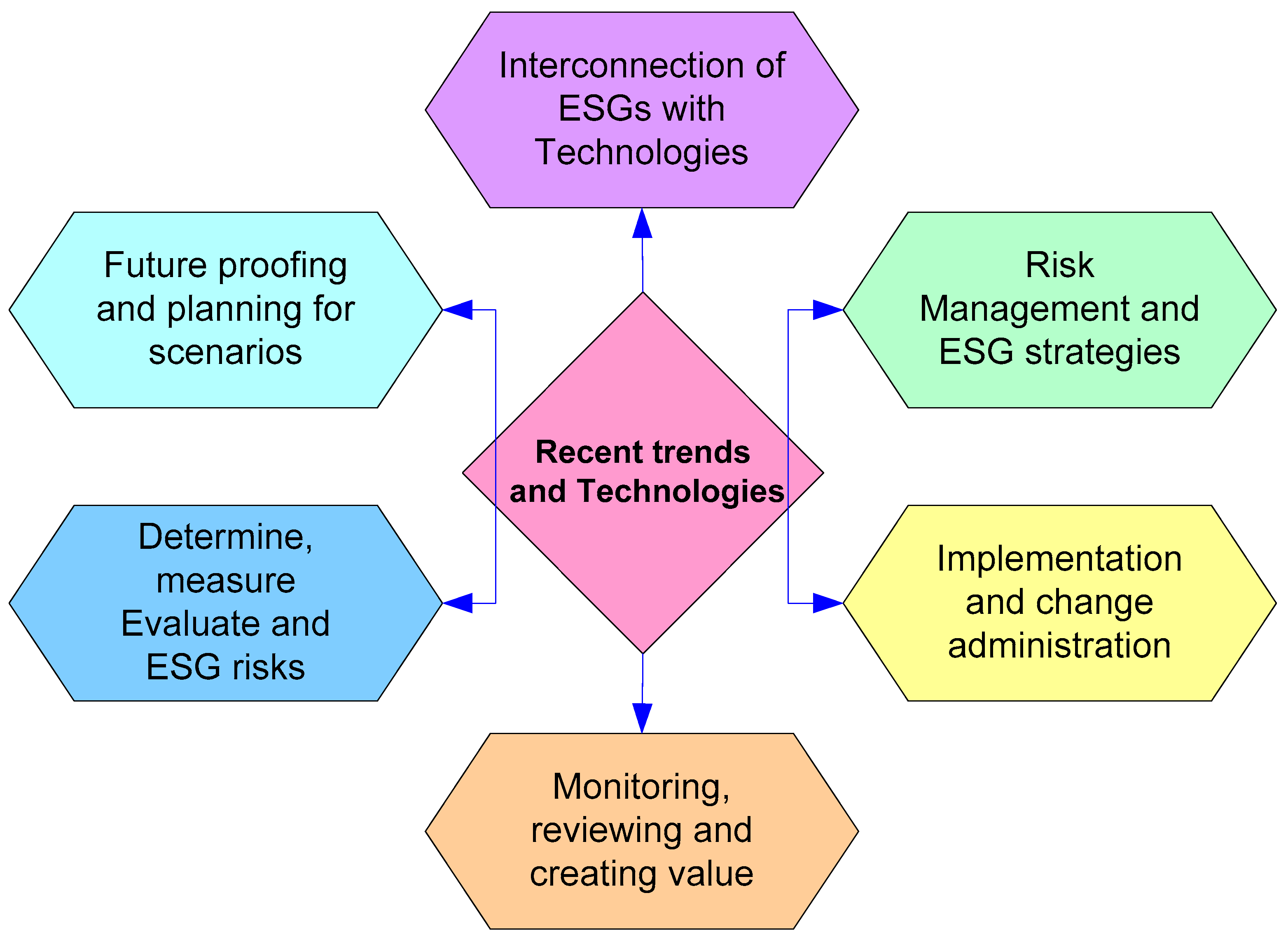

How can investors address the Net Zero credibility gap?

The world is falling short in efforts to hit Net Zero by 2050. How can investors spot the opportunities and let action match the rhetoric.

-

A global view drives better returns on sustainable investments

There's a lot more to ESG than just the environment. That's why looking at the bigger picture - at global trends, policy frameworks and unexpected events - is so important to understand the impact on corporate performance. Find out how we apply a macro lens to the micro detail.

How Gender Equality Can Empower the Global Economy

In today’s macro environment, stronger diversity and inclusion policies from companies and governments could provide the global economy a much-needed shot in the arm.

Valuing the natural world

Biodiversity is vital to our survival, but how do we begin to value something so universal and yet diverse? Discover the untapped investment potential of natural capital and the impact biodiversity-focused investment can have on protecting our planet.

Sustainable Investing

Sustainability is a key consideration across our company. That’s because we believe applying ESG factors leads to more constructive engagement and better-informed investment decisions.