CFD TRADING ON CRYPTOCURRENCIES

CFDs trading are derivatives, which enable you to speculate on cryptocurrency price movements without taking ownership of the underlying coins. You can go long (‘buy’) if you think a cryptocurrency will rise in value, or short (‘sell’) if you think it will fall. Both Are Leveraged products, meaning you only need to put up a small deposit – known as margin – to gain full exposure to the underlying market. Your profit or loss are still calculated according to the full size of your position, so leverage will magnify both profits and losses.

Buying and selling cryptocurrencies via an exchange

When you buy cryptocurrencies via an exchange, you purchase the coins themselves. You’ll need to create an exchange account, put up the full value of the asset to open a position, and store the cryptocurrency tokens in your own wallet until you’re ready to sell. Exchanges bring their own steep learning curve as you’ll need to get to grips with the technology involved and learn how to make sense of the data. Many exchanges also have limits on how much you can deposit, while accounts can be very expensive to maintain.

-

How do cryptocurrency markets work?

Cryptocurrency markets are decentralized, which means they are not issued or backed by a central authority such as a government. Instead, they run across a network of computers. However, cryptocurrencies can be bought and sold via exchanges and stored in ‘wallets’ . Unlike traditional currencies, cryptocurrencies exist only as a shared digital record of ownership, stored on a blockchain. When a user wants to send cryptocurrency units to another user, they send it to that user’s digital wallet. The transaction isn’t considered final until it has been verified and added to the blockchain through a process called mining. This is also how new cryptocurrency tokens are usually created.

-

What is blockchain?

A blockchain is a shared digital register of recorded data. For cryptocurrencies, this is the transaction history for every unit of the cryptocurrency, which shows how ownership has changed over time. Blockchain works by recording transactions in ‘blocks’, with new blocks added at the front of the chain.

Blockchain technology has unique security features that normal computer files do not have.

Network Consensus

A blockchain file is always stored on multiple computers across a network – rather than in a single location – and is usually readable by everyone within the network. This makes it both transparent and very difficult to alter, with no one weak point vulnerable to hacks, or human or software error.

Cryptography

Blocks are linked together by cryptography – complex mathematics and computer science. Any attempt to alter data disrupts the cryptographic links between blocks, and can quickly be identified as fraudulent by computers in the network.

What Is Cryptocurrency Mining?

Cryptocurrency mining is the process by which recent cryptocurrency transactions are checked and new blocks are added to the blockchain.

Checking Transactions

Mining computers select pending transactions from a pool and check to ensure that the sender has sufficient funds to complete the transaction. This involves checking the transaction details against the transaction history stored in the blockchain. A second check confirms that the sender authorized the transfer of funds using their private key.

Checking Transactions

Mining computers select pending transactions from a pool and check to ensure that the sender has sufficient funds to complete the transaction. This involves checking the transaction details against the transaction history stored in the blockchain. A second check confirms that the sender authorized the transfer of funds using their private key.

Creating A New Block

Mining computers compile valid transactions into a new block and attempt to generate the cryptographic link to the previous block by finding a solution to a complex algorithm. When a computer succeeds in generating the link, it adds the block to its version of the blockchain file and broadcasts the update across the network.

What Moves Cryptocurrency Markets?

Cryptocurrency markets move according to supply and demand. However, as they are decentralized, they tend to remain free from many of the economic and political concerns that affect traditional currencies. While there is still a lot of uncertainty surrounding cryptocurrencies, the following factors can have a significant impact on their prices:

Supply: the total number of coins and the rate at which they are released, destroyed or lost

Market Capitalization: the value of all the coins in existence and how users perceive this to be developing

Press: the way the cryptocurrency is portrayed in the media and how much coverage it is getting

Integration: the extent to which the cryptocurrency easily integrates into existing infrastructure such as e-commerce payment systems.

Key Events: major events such as regulatory updates, security breaches and economic setbacks

How Does Cryptocurrency Trading Work?

With IG, you can trade cryptocurrencies via a CFD account – derivative products that enable you speculate on whether your chosen cryptocurrency will rise or fall in value. Prices are quoted in traditional currencies such as the US dollar, and you never take ownership of the cryptocurrency itself.

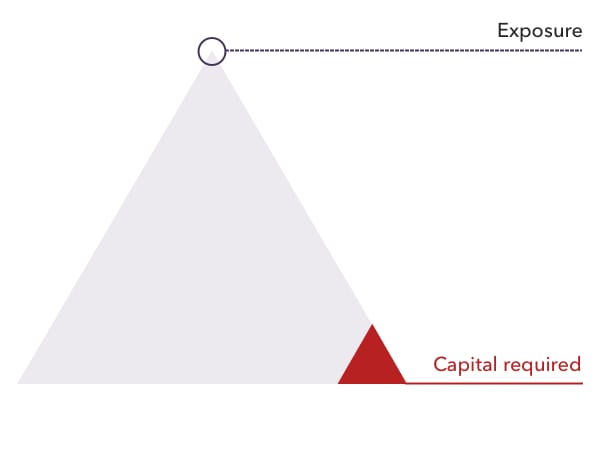

CFDs are leveraged products, which means you can open a position for a just a fraction of the full value of the trade. Although leveraged products can magnify your profits, they can also magnify losses if the market moves against you.

What Is The Spread In Cryptocurrency Trading?

The spread is the difference between the buy and sell prices quoted for a cryptocurrency. Like many financial markets, when you open a position on a cryptocurrency market, you’ll be presented with two prices. If you want to open a long position, you trade at the buy price, which is slightly above the market price. If you want to open a short position, you trade at the sell price – slightly below the market price.

What Is A Lot In Cryptocurrency Trading?

Cryptocurrencies are often traded in lots – batches of cryptocurrency tokens used to standardize the size of trades. As cryptocurrencies are very volatile, lots tend to be very small: most are just one unit of the base cryptocurrency. However, some cryptocurrencies are traded in bigger lots.

What Is Leverage In Cryptocurrency Trading?

Leverage is the means of gaining exposure to large amounts of cryptocurrency without having to pay the full value of your trade upfront. Instead, you put down a small deposit, known as margin. When you close a leveraged position, your profit or loss is based on the full size of the trade.

While leverage will magnify your profits, it also brings the risk of amplified losses – including losses that can exceed your margin on an individual trade. Leveraged trading therefore makes it extremely important to learn how to manage your risk.

FAQs

Target Capital Assets offers trading on nine of the most valuable cryptocurrencies: bitcoin, bitcoin cash, bitcoin gold, ether, ripple, litecoin, EOS, stellar (XLM) and NEO.

Risk Management

HOW TO MANAGE YOUR TRADING RISK

CFD trading comes with a unique set of risk. That’s why we’ve compiled a guide with risk management tips, tools and techniques. Find out how to manage your trading risk when using leveraged derivatives, and access our free educational resources.